| Prompt | Response | Req | Len |

|---|---|---|---|

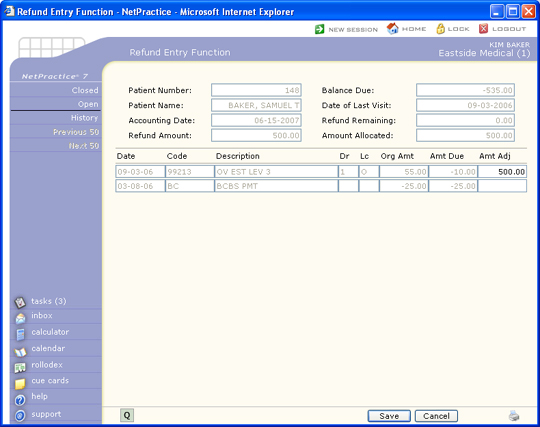

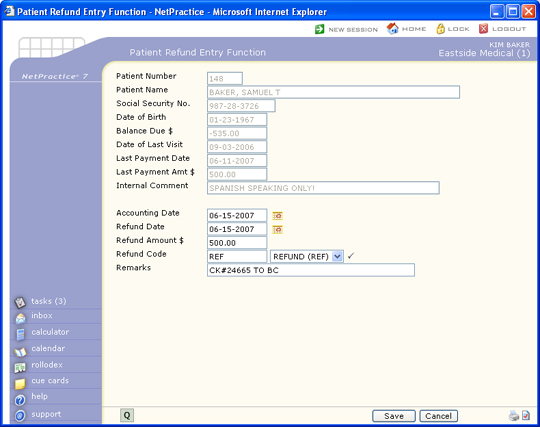

| Social Security No. | 12 | ||

| Date of Birth | 10 | ||

| Balance Due $ | 10 | ||

| Date of Last Visit | 10 | ||

| Last Payment Date | 10 | ||

| Last Payment Amt $ | 10 | ||

| Internal Comment | 45 | ||

| Accounting Date | 10 | ||

| Refund Date | 10 | ||

| Refund Amount $ | Enter the Amount of the Credit or 'Q' to Quit | 10 | |

| Refund Code | Enter a Refund Code from the Adjustment Code Table or HELP for a List |  |

10 |

| Remarks | Enter An Optional Comment | 40 |